Source: Austin Board of REALTORS® MLS (ABoR)

Coverage: Residential sales across Austin and Central Texas, January 2022 – September 2025

Metrics: Median Sale Price, Closed Sales, Sales Dollar Volume, Months of Inventory, New Listings, Active Listings

1) Year-over-year (YoY) comparison

Reference months:

- Latest: September 2025

- Same month last year: September 2024

- Two years ago: September 2023

| Metric | Sep 2025 | Sep 2024 | change vs 2024 | Sep 2023 | change vs 2023 |

|---|---|---|---|---|---|

| Median Sale Price | $420,000 | $425,000 | −1.18% | $452,080 | −7.10% |

| Closed Sales (count) | 2,416 | 2,286 | +5.69% | 2,387 | +1.21% |

| Months of Inventory | 5.7 | 5.0 | +14.0% | 4.0 | +42.5% |

| New Listings | 3,327 | 3,545 | −6.15% | 3,644 | −8.70% |

| Active Listings | 13,665 | 12,153 | +12.44% | 10,235 | +33.51% |

Takeaway from the snapshot: Median price is down slightly vs last year (and more so vs 2023), while inventory (active listings & months of inventory) is meaningfully higher. Closed sales rose modestly vs Sep 2024 and are roughly flat vs Sep 2023. New listings are lower than both 2024 and 2023, even as active listings sit much higher — a signal that listings are staying on market longer.

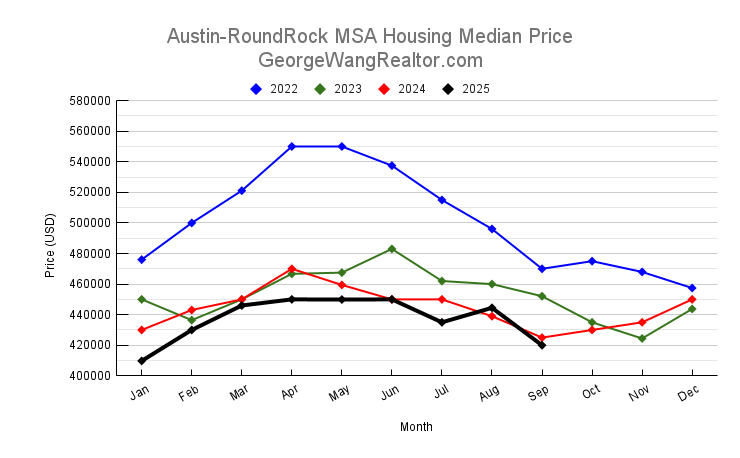

2) Median sale price — trend analysis

What the numbers say (high level):

- 2022 shows higher medians (peaking around $550k in spring 2022).

- During 2023 medians fell into the mid-$400k range (Sep 2023 ≈ $452k).

- 2024 medians hovered around $425–$450k (Sep 2024 = $425k).

- 2025 shows a modest decline into the low $400k by Sep (Sep 2025 = $420k).

Interpretation:

- The market median rose to a spring 2022 high, then retrenched through 2023 and stabilized in the high-$400ks to low-$400ks band in 2024–2025.

- From Sep 2024 → Sep 2025 the median fell ~1.2%, and from Sep 2023 → Sep 2025 it fell ~7.1%. That indicates the big pullback occurred after 2022/early 2023, and 2024–2025 are more of a stabilization or modest downward drift rather than another sharp collapse.

- Combined with rising inventory (see below), price pressure is present but currently moderate — buyers have more choices than in 2021–22, which keeps medians from moving higher.

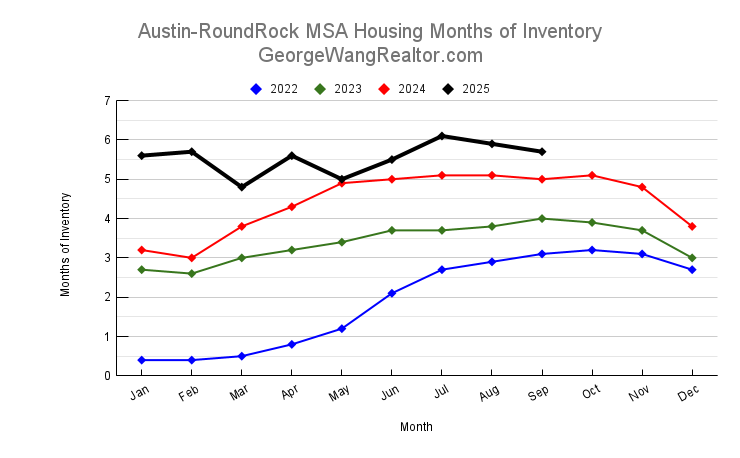

3) Months of inventory — trend analysis

What the numbers show:

- 2022 months of inventory were very low (well under 1 month early in the year, rising to ~3 by fall).

- By 2023 it climbed into the ~3–4 month range (Sep 2023 = 4.0).

- 2024–2025 show materially higher inventory: Sep 2024 = 5.0 months; Sep 2025 = 5.7 months.

Interpretation:

- Months of inventory has shifted from seller’s market territory (sub-2 months widely considered very tight) in 2022 to balanced or buyer-leaning territory by 2024–2025 (5+ months is commonly interpreted as an inventory surplus relative to typical demand).

- From Sep 2024 → Sep 2025 months of inventory increased ~14%, and from Sep 2023 → Sep 2025 it increased ~42.5%. That’s a meaningful structural change: more listings are active relative to recent sales, giving buyers more negotiating leverage and reducing upward pressure on prices.

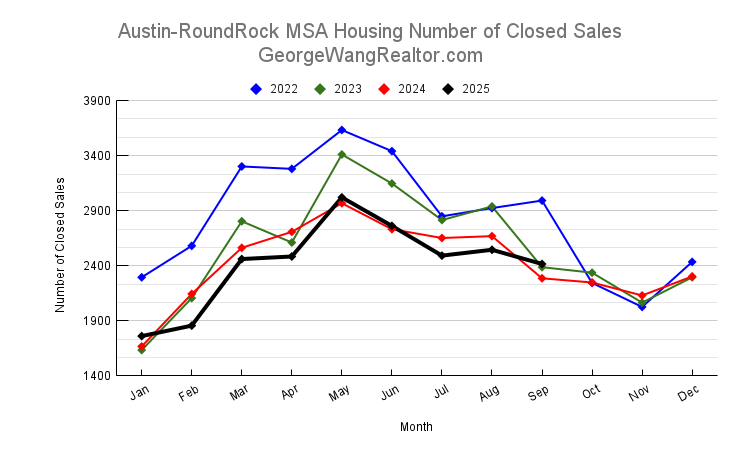

4) Closed sales — trend analysis

Numbers:

- Sep 2022: 2,992 closed sales (strong activity).

- Sep 2023: 2,387 (drop vs 2022).

- Sep 2024: 2,286 (further small drop).

- Sep 2025: 2,416 (a modest rebound vs 2024).

Interpretation:

- Closed sales fell sharply from 2022 to 2023 as the market normalized and higher rates/uncertainty cooled demand.

- 2024 saw a slight further dip, but 2025 shows a modest recovery (+5.7% vs Sep 2024 and +1.2% vs Sep 2023).

- The uptick in closed sales during 2025 alongside higher active listings suggests some buyers are returning or transactions are happening at a steadier clip — but because inventory has increased more strongly, the market balance still tilts toward buyers compared with 2022.

5) New listings — trend analysis

Numbers (September):

- Sep 2022: 3,967 new listings

- Sep 2023: 3,644 new listings

- Sep 2024: 3,545 new listings

- Sep 2025: 3,327 new listings

Interpretation:

- New listings have declined gradually year-over-year: Sep 2025 is down ~6.1% vs Sep 2024 and ~8.7% vs Sep 2023, and ~16% vs Sep 2022.

- At first glance fewer new listings but higher active listings seems contradictory — the explanation in the data is that listings are accumulating (active counts are rising) because supply is staying on market longer (higher months of inventory), not because more new homes are entering the pipeline.

- In plain terms: sellers may be pricing to test the market or taking longer to transact, leading to inventory build despite fewer fresh starts each month.

Conclusion (copy-ready)

September 2025 data show Austin & Central Texas continuing its multi-year shift from the ultra-tight seller’s market of 2021–early-2022 to a more balanced, buyer-friendly market. Median sale price has eased modestly (Sep 2025 median = $420,000, down ~1.2% vs Sep 2024 and ~7.1% vs Sep 2023), while inventory metrics have moved substantially — active listings and months of inventory are meaningfully higher. Closed sales have ticked up slightly in 2025, but the combination of rising active listings and lower new-listing flow means homes are staying on market longer. For sellers, that points to more realistic pricing and better marketing execution; for buyers, it means more choices and negotiating power compared with the 2021–22 boom. As always, seasonal swings matter (springs remain the most active), so watch inventory and median price moves through the late-year cycle to see whether 2025’s higher supply begins to stabilize prices or puts more downward pressure into 2026.

If you have any questions or need any assistance in finding your new home or investment property, please contact me and I will be more than happy to work with you. You can read my client testimonials here.

Please also check out our rebate program which is a win-win situation for my buyer.