The Williamson County residential real estate market continues to show subtle but important shifts as we enter Q2 of 2025. Drawing from Austin ABOR MLS data, we explore how the market has evolved by comparing April 2025 with the same month in 2024 and 2023. Let’s break down the trends and key takeaways across median sale prices, inventory, sales volume, and listings.

1. Year-over-Year Comparison (April 2025 vs. April 2024 and 2023)

| Metric | April 2023 | April 2024 | April 2025 | YoY % Change (2025 vs 2024) | YoY % Change (2025 vs 2023) |

|---|---|---|---|---|---|

| Median Sale Price | $445,000 | $435,000 | $435,920 | +0.2% | -2.1% |

| Closed Sales | 919 | 939 | 817 | -13.0% | -11.1% |

| Sales Dollar Volume ($B) | 0.457 | 0.458 | 0.400 | -12.7% | -12.5% |

| Months of Inventory | 2.6 | 3.4 | 4.8 | +41.2% | +84.6% |

| New Listings | 1247 | 1518 | 1734 | +14.2% | +39.0% |

| Active Listings | 2346 | 2936 | 3869 | +31.8% | +64.9% |

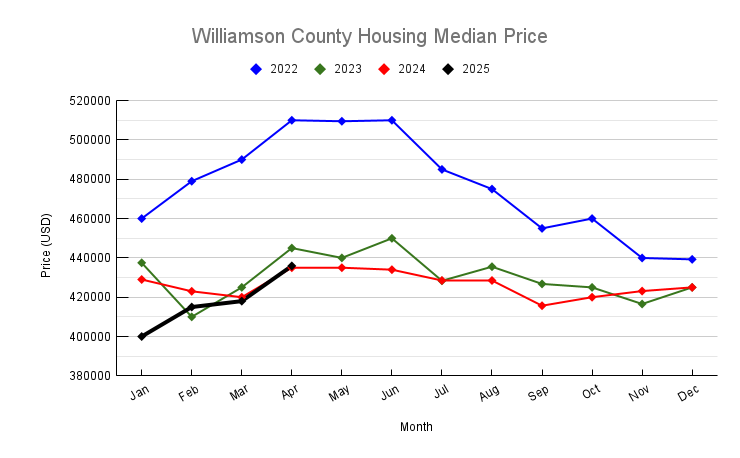

2. Median Sale Price Trend: Plateauing After Pandemic Boom

The median sale price for Williamson County in April 2025 is $435,920, a negligible increase of 0.2% from April 2024 and a 2.1% decline from April 2023. This suggests the once-red-hot price growth from 2020 to mid-2022 has completely cooled.

Observed Trend:

- After peaking at $510,000 in early 2022, median prices gradually declined through 2023.

- Since mid-2023, prices have essentially plateaued around the $420K–$435K range, indicating market stabilization.

- This may reflect buyer pushback on affordability issues, combined with greater inventory.

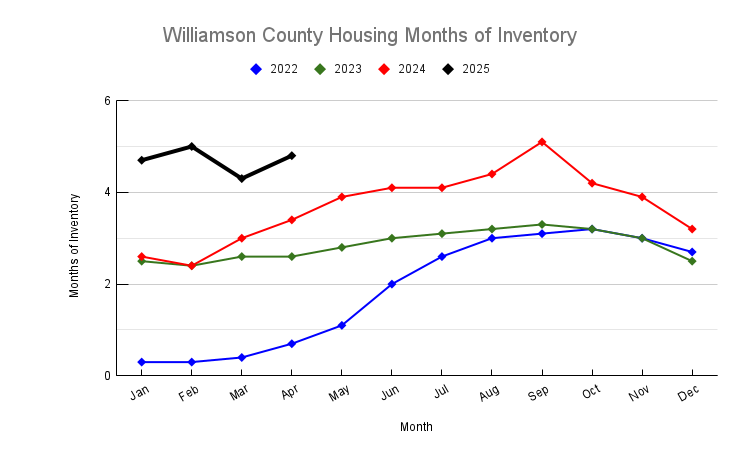

3. Months of Inventory: Sharp Rise Signals a Buyer’s Market

Inventory has steadily increased from 2.6 months in April 2023 to 4.8 months in April 2025 — an 85% jump in two years.

Interpretation:

- A balanced market is often considered to be around 5–6 months of inventory.

- The Austin market is quickly approaching that threshold, suggesting more leverage for buyers.

- Builders and sellers may face longer sell times unless they price more competitively.

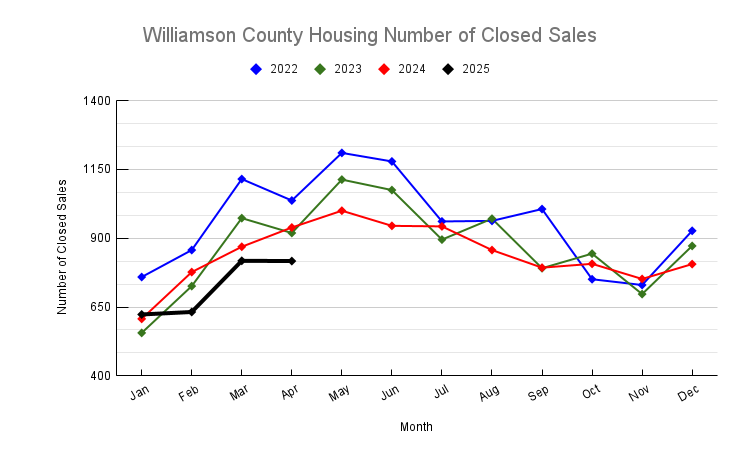

4. Closed Sales: Demand Remains Subdued

April 2025 saw 817 closed sales, down from 939 in April 2024 and 919 in April 2023 — a two-year decline of 11.1%.

Analysis:

-

This indicates demand remains soft, possibly due to:

- High interest rates

- Persistent affordability concerns

- Consumer uncertainty

- The drop in sales dollar volume (-12.7% YoY) also confirms that fewer homes are selling, and at slightly lower prices.

5. New Listings: Seller Activity Continues to Rise

April 2025 saw 1,734 new listings, up 14.2% from April 2024 and 39% from April 2023.

Key Observations:

- This rise in seller activity, despite cooling demand, is causing inventory to balloon.

- The market may be experiencing a mismatch between seller expectations and buyer willingness, putting downward pressure on pricing and increasing time on market.

Conclusion: Market Tilting Toward Buyers Amid Inventory Surge

The Williamson County housing market is clearly undergoing a normalization phase. Prices are no longer surging, but rather holding steady — slightly down from peak levels. However, the inventory continues to climb, with a shrinking buyer pool and fewer closed sales, indicating a shift toward a buyer’s market.

This creates both opportunities and challenges: buyers gain negotiating power, while sellers need to stay agile with pricing and timing. As we move into the summer months, watching how demand reacts to increased inventory will be critical in determining whether this softening trend continues or stabilizes further.

If you have any questions or need any assistance in finding your new home or investment property, please contact me and I will be more than happy to work with you. You can read my client testimonials here.

Please also check out our rebate program which is a win-win situation for my buyer.