The decision to buy or rent a house depends on various factors, and there isn’t a one-size-fits-all answer. However, numbers won’t lie, in this blog, we will take a close look from the financial/number side, because building equity is one of most important aspects of house ownership, besides living quality, stability and security.

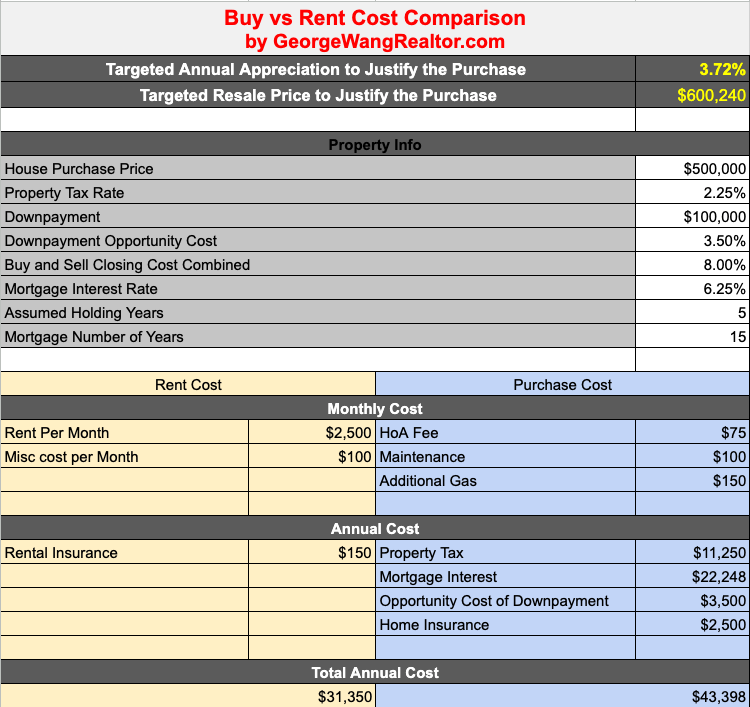

The spreadsheet I created is to determine the required annual appreciation in house value to offset the cost difference between buying and renting. In the provided example, the annual appreciation in house value must be 3.72% over the five-year ownership period to cover the additional expenses associated with purchasing and owning the house. The spreadsheet is based on assumptions of a $500,000 house price, a 6.25% interest rate on a 15-year fixed mortgage, a 20% downpayment, and approximately 2.25% property tax. These figures were typical for the Austin area at the time this blog was written.

Below are some observations from this spreadsheet, all these are very helpful information for buyers to decide if they should buy or rent:

1. The longer your intended duration of stay, the earlier you should contemplate home ownership. With an extended ownership period, the required annual appreciation rate to justify the purchase decreases. For instance, using the same configuration as in the aforementioned spreadsheet, the table below illustrates that the more years you own a house, the greater the appreciation value you can experience. The tipping point occurs around four to five years. However, if you anticipate selling the house within three years, especially with prevailing high interest rates (>5%), renting might be a more favorable option.

| Number of years owning the house | 3 | 5 | 7 | 10 |

| Annual appreciation rate to jusity the purchase | 5.05% | 3.72% | 3.01% | 2.27% |

B. A decrease in mortgage interest rates will significantly diminish the annual appreciation rate rationale for buying. Once more, for those intending to sell the house within five years, a 7% interest loan would necessitate an annual appreciation of 4.21%, whereas a 4% loan would only require 2.25% annual appreciation. A 5% interest rate would prove considerably more appealing to potential home buyers. See the table below.

| Mortgage interest rate | 3% | 4% | 5% | 6% | 7% |

| Annual appreciation to jusity the purchase | 1.58% | 2.25% | 2.91% | 3.56% | 4.21% |

C. The commission and closing costs significantly impact the overall cost of purchasing a house. A decrease in commission leads to a shorter period for house price appreciation to offset the additional purchase expenses. As depicted in the table below, when commission/closing costs decrease from 8% to 4%, homebuyers can experience an additional appreciation of 0.7% per year.

| Commission/Closing cost | 4% | 5% | 6% | 7% | 8% |

| Annual appreciation to jusity the purchase | 3.02% | 3.20% | 3.37% | 3.55% | 3.72% |

As a real estate agent with 10+ years of experience, almost all my buyers have enjoyed the big commission rebate/closing cost savings when I help them purchase a home. You can check out our rebate program which is a win-win situation for my buyers.

Please contact me if you have any questions and I will be more than happy to work with you. You can read my client testimonials here.

If you are interested in obtaining a copy of the spreadsheet, please contact me.